Shopify Flow automation, when combined with memberr's Store Credit capabilities, creates powerful opportunities for enhancing customer engagement and driving repeat purchases. This guide explores how to effectively integrate memberr Store Credit actions into your Shopify Flows for automated customer rewards and engagement.

Availble memberr Store Credit Nodes

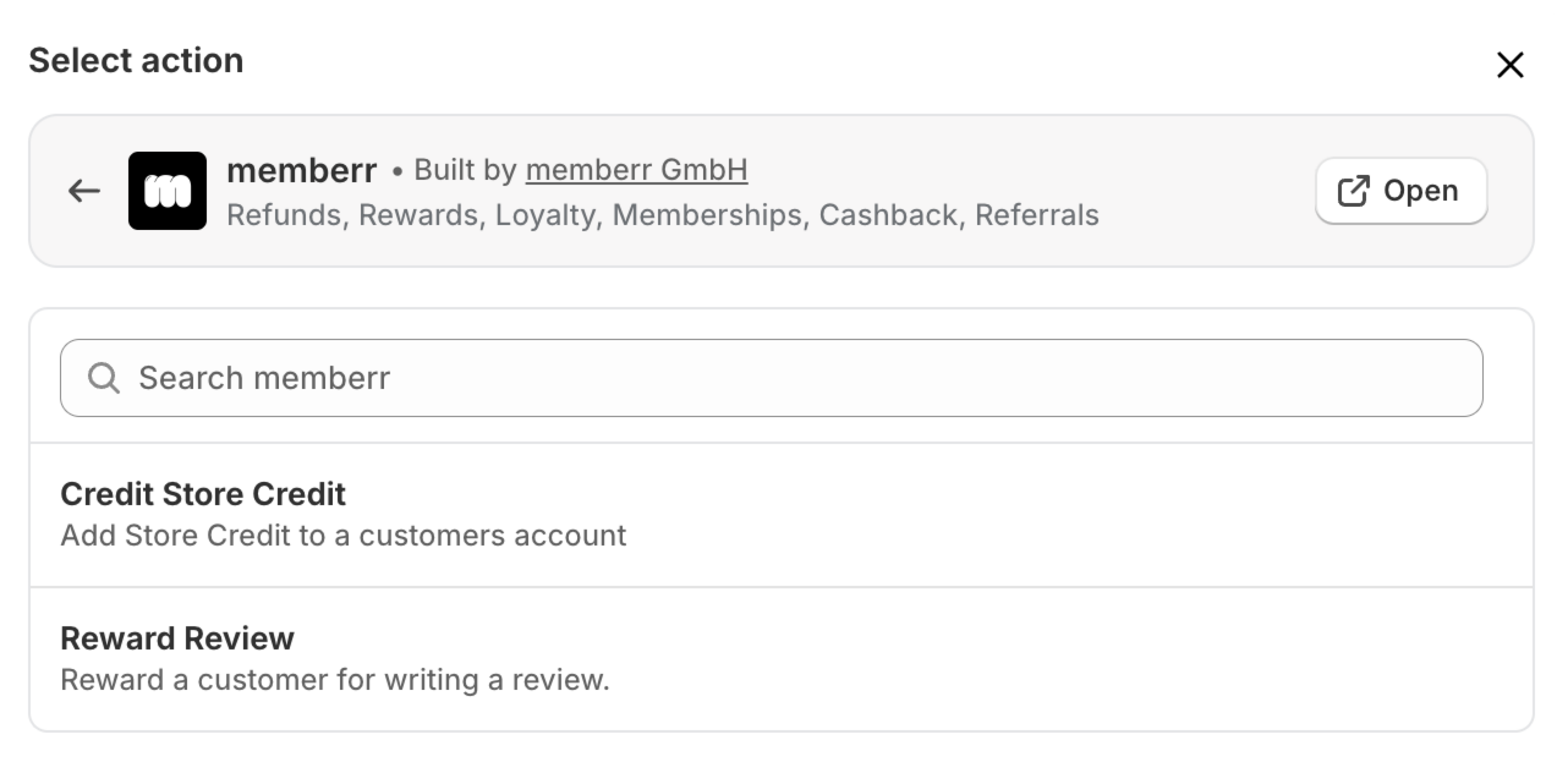

memberr Shopify Flow actions:

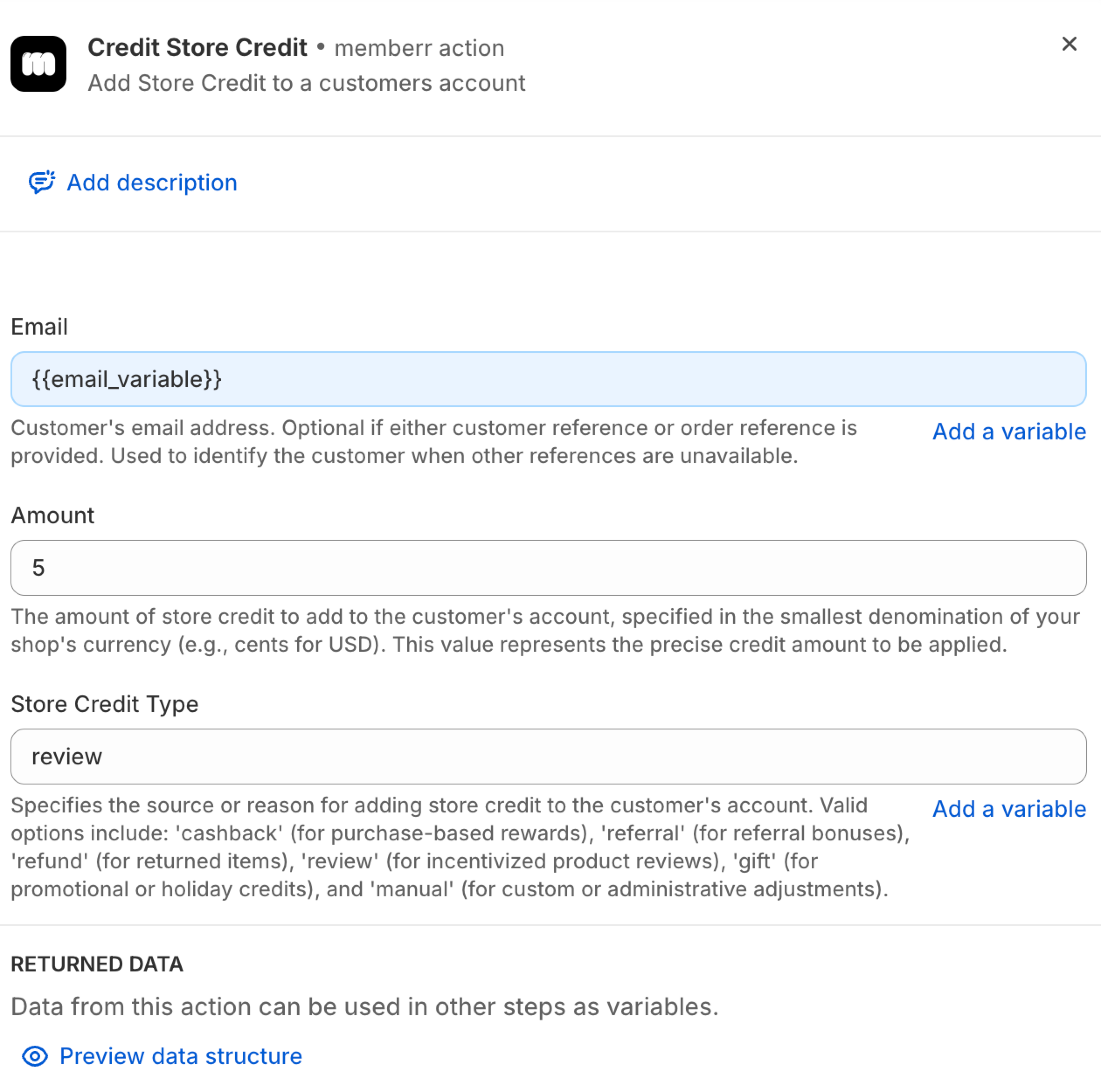

- Store Credit Credit (Send Store Credit to a customer)

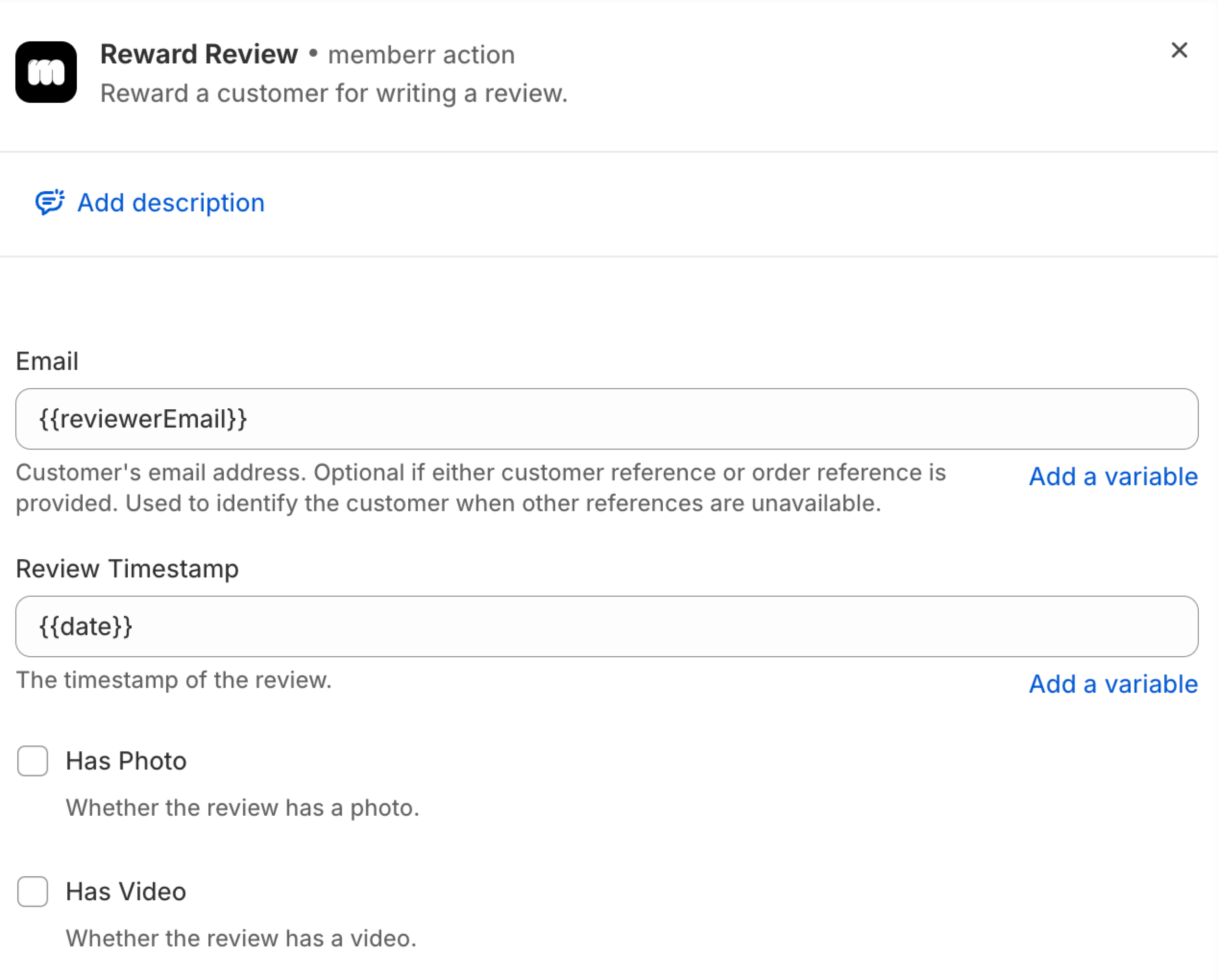

- Reward Review (Dedicated action node for rewarding reviews with Store Credit)

Essential Shopify Flow Components with memberr

Shopify Flow provides flexibility for automating Store Credit actions through memberr. The key components include triggers that initiate the flow, conditions that determine when Store Credit should be issued, and actions that execute the credit issuance. memberr integrates seamlessly with these components, allowing for automated Store Credit distribution based on various customer behaviors and events.

Core Flow Implementations

Order completion flows represent the most fundamental automation opportunity. When a customer completes a purchase, you can automatically trigger Store Credit rewards based on order value. For instance, configure a flow that issues Store Credit worth 5% of the purchase amount for orders over $100. This immediate reward encourages future purchases while the transaction experience is still fresh.

Product review submissions can trigger automatic Store Credit rewards. Set up a flow that monitors for new product reviews and automatically issues Store Credit to the reviewer. This incentivizes customer feedback while building loyalty. Consider varying the credit amount based on review quality metrics such as including photos or meeting minimum word counts.

Customer tier advancement deserves recognition through automated rewards. Create flows that issue bonus Store Credit when customers reach new spending thresholds or loyalty tiers. This automated recognition helps maintain engagement with your most valuable customers and encourages continued patronage.

Basic Store Credit Flow Implementation

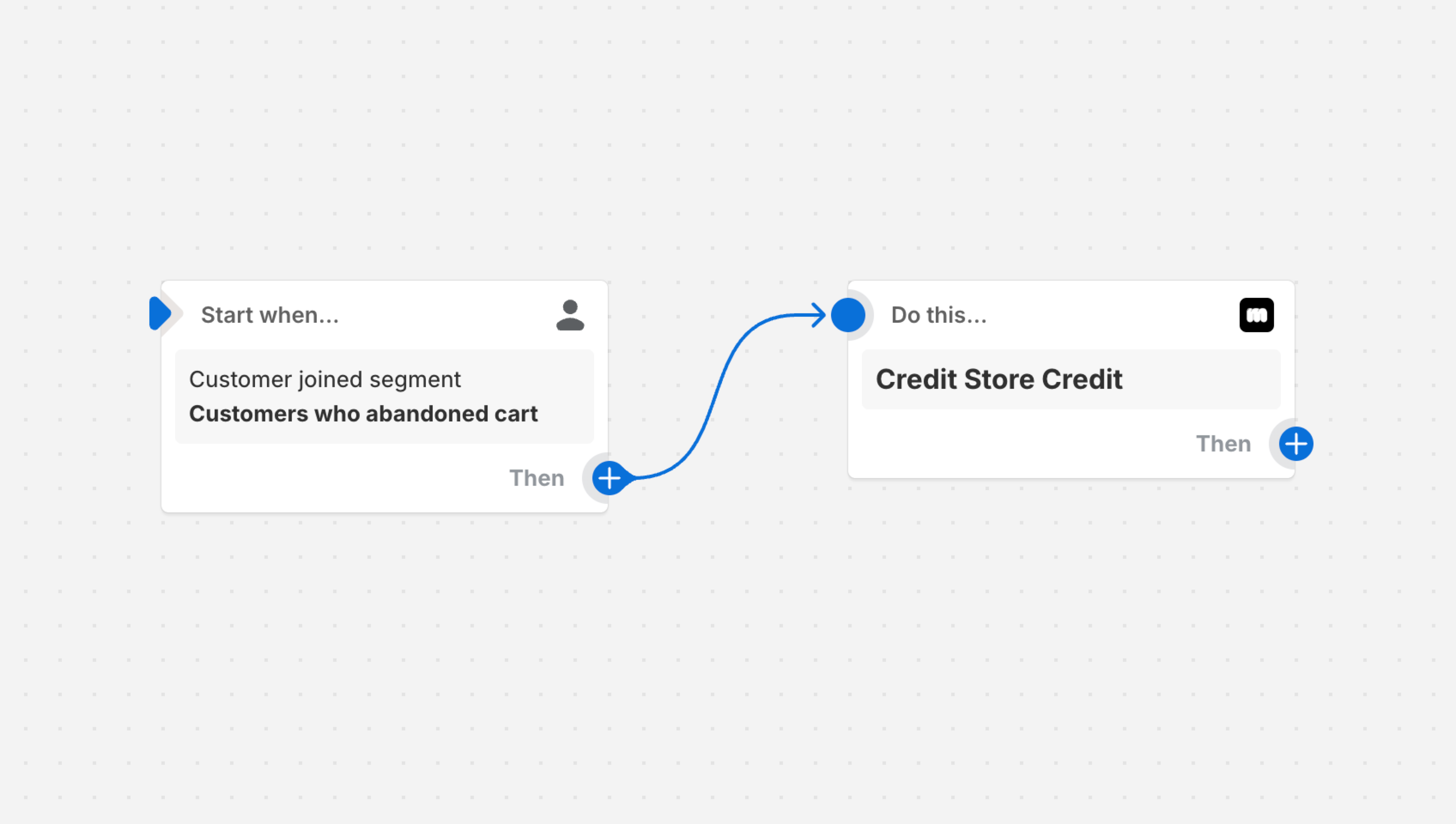

A typical flow using memberr store credit nodes is a flow where a customer segment is defind and an action node adds or removes store credit once a customer becomes a part of the segment.

- Tigger Node:

Customer joined segment(Example: Abandoned checkout in the last 30 days) - Action Node:

memberr: Credit Store Credit

Hands on example

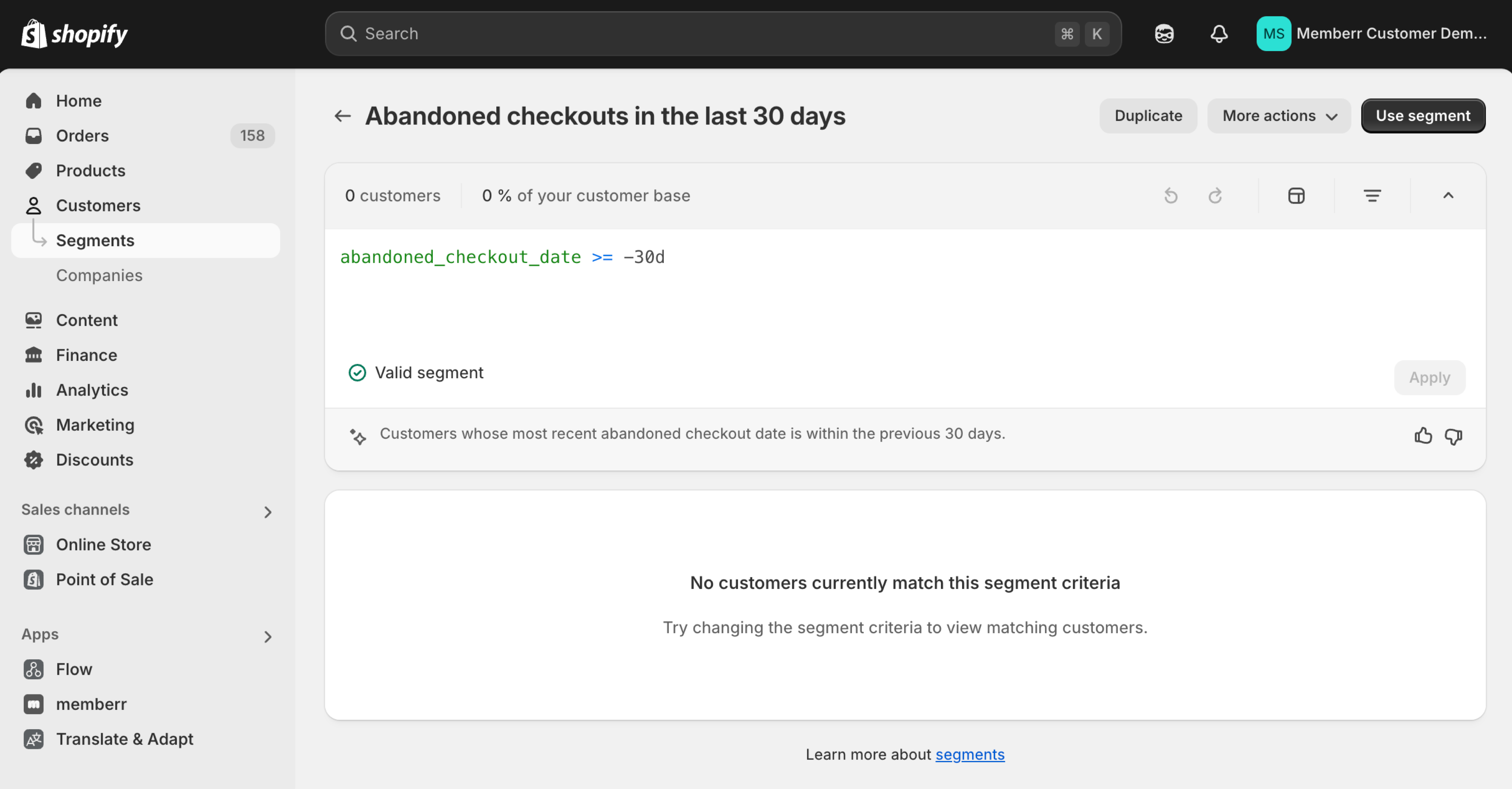

Step 1. Create a customer segment

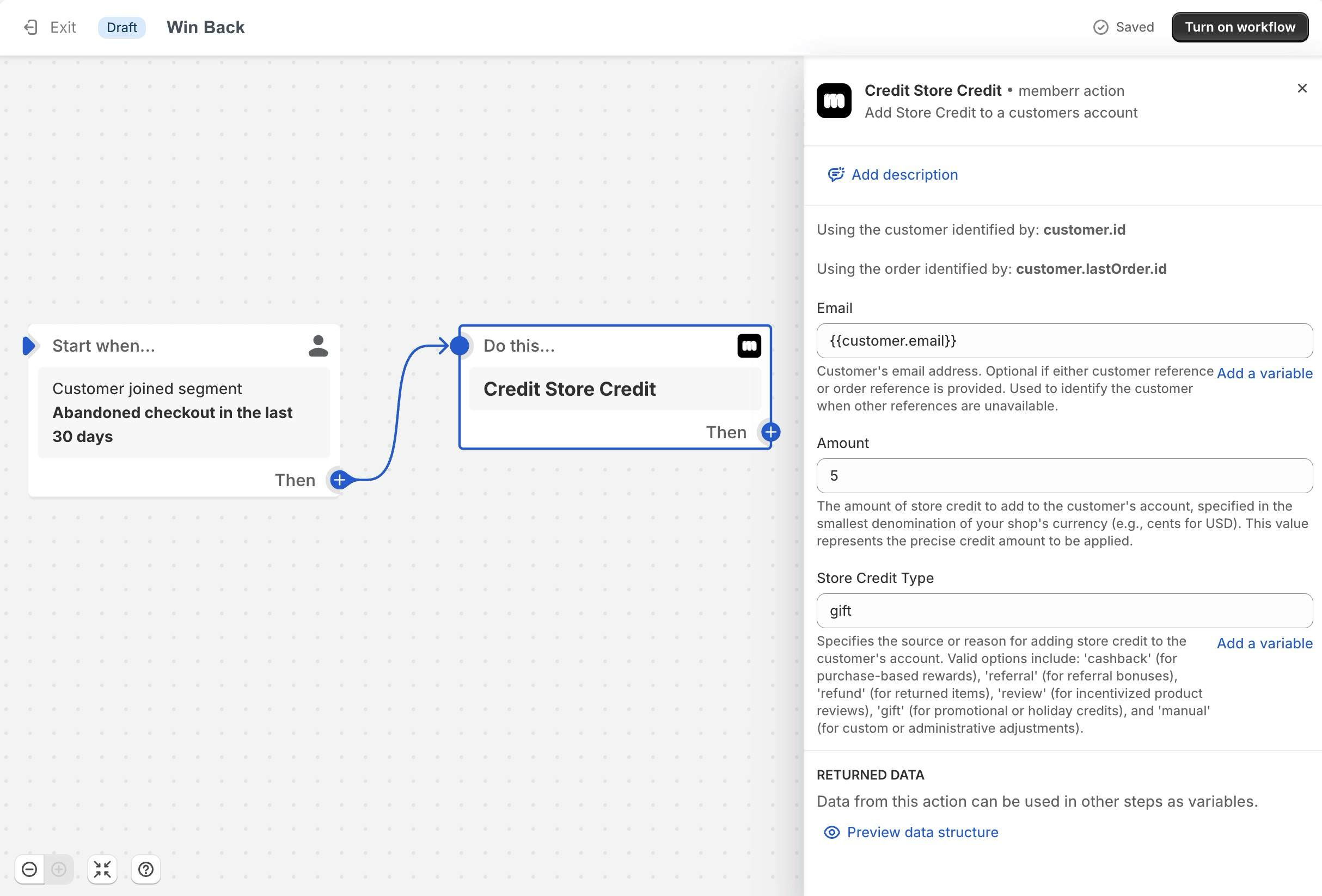

Step 2. Create the flow

In this example flow we send €5 Store Credit to every customer that has abandoned the store checkout without making a purchase.

memberr Shopify Flow Configuration

More Examples

Cart abandonment recovery can be enhanced through strategic Store Credit automation. Configure flows that identify high-value abandoned carts and automatically issue time-limited Store Credit as a recovery incentive. This approach often proves more effective than standard discount codes, as it keeps the reward within your store ecosystem.

First-time customer flows should focus on encouraging second purchases. Set up automation that issues Store Credit after a customer's first order ships, specifically timed to arrive when they're likely to be satisfied with their purchase. This strategic timing helps establish a pattern of repeat purchases early in the customer relationship.

Birthday and milestone celebrations can be automated through Shopify flows. Configure your system to automatically issue Store Credit on customer birthdays or purchase anniversaries. These personal touches help strengthen customer relationships through automated but meaningful recognition.

Technical Implementation Considerations

When implementing memberr Store Credit actions in Shopify flows, careful attention to timing and conditions is essential. Each flow should include appropriate availabilty delays and to ensure credits are issued at optimal moments in the customer journey. For example, order-based credits might wait until after the return window closes to prevent potential abuse.

Conditional logic plays a crucial role in sophisticated flow design. Use Shopify's condition builders to create precise rules for credit issuance. Consider factors such as order history, customer tags, and previous credit usage when determining eligibility and credit amounts. This granular control helps prevent overexposure while maximizing effectiveness.

Testing is crucial before activating any automated credit flow. Start with small customer segments and modest credit amounts to verify proper functioning. Monitor credit issuance patterns and customer behavior to ensure the automation achieves desired outcomes without unintended consequences.

Performance Monitoring

Track key metrics to evaluate flow effectiveness. Monitor credit redemption rates, time to redemption, and subsequent purchase behavior for customers who receive automated credits. This data helps optimize flow timing and credit amounts for maximum impact.

Use Shopify's native analytics alongside memberr's reporting capabilities to measure the success of your automated credit programs. Pay particular attention to the relationship between credit issuance and customer lifetime value to ensure your automation strategy drives sustainable business growth.